Introduction:

Benefits of Understanding the Various Types of Doji Candlesticks in Forex Trading:

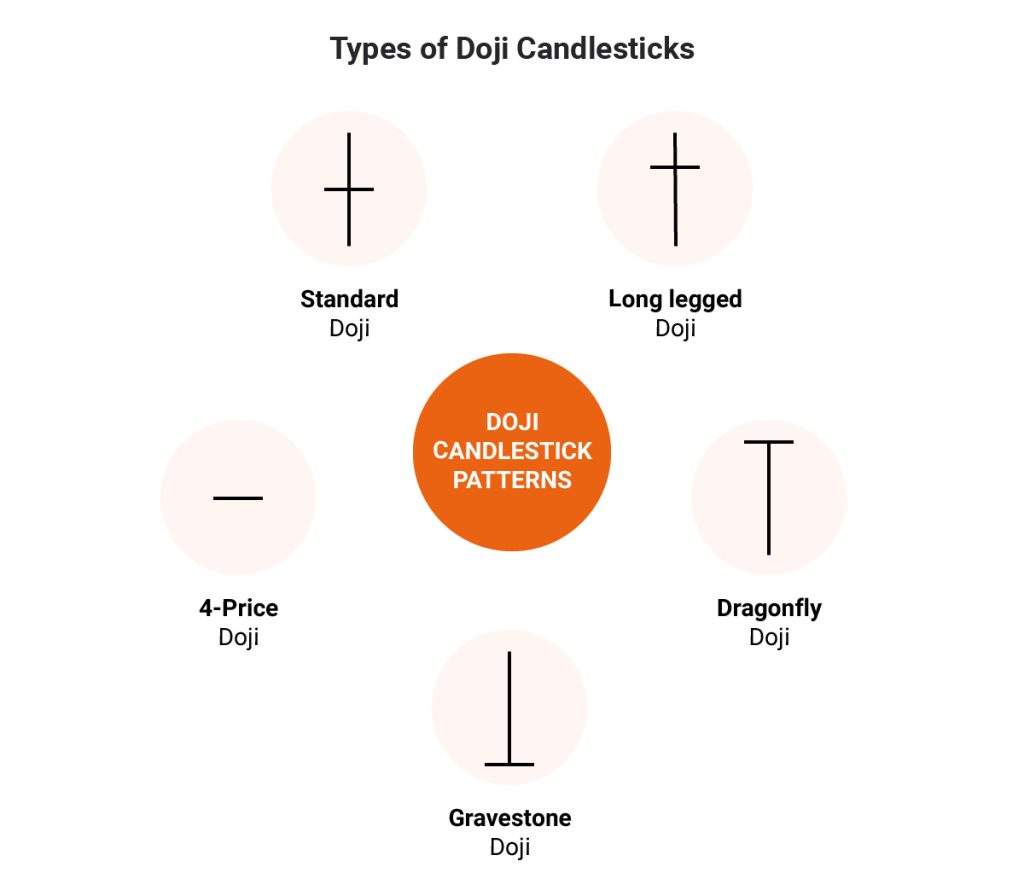

In the realm of forex trading, candlestick patterns serve as invaluable tools for traders to analyze market sentiment and predict potential price movements. Among these patterns, the Doji candlestick holds a special significance due to its unique structure and the insights it offers into market indecision. Doji candles represent situations where the opening and closing prices are virtually the same, signaling a balance between buyers and sellers. However, within the realm of Doji candles, there exist several variations, each with its implications for traders. In this article, we’ll delve into the various types of Doji candlesticks, exploring their characteristics and significance in forex trading.

Classic Doji:

The Classic Doji is the simplest form, characterized by a small body with upper and lower wicks of roughly equal length, indicating a state of indecision in the market. This candlestick suggests that neither bulls nor bears were able to gain control during the trading session, resulting in a standoff between buyers and sellers. Traders often interpret the appearance of a Classic Doji after a prolonged uptrend or downtrend as a potential reversal signal, especially when it occurs at key support or resistance levels.

Long-Legged Doji:

The Long-Legged Doji, as the name implies, is distinguished by longer upper and lower wicks compared to the body. This signifies a higher level of indecision and volatility in the market. Traders interpret the Long-Legged Doji as a stronger signal of a potential trend reversal or significant market indecision, especially when it appears after a prolonged period of price volatility or uncertainty.

Gravestone Doji:

The Gravestone Doji features a long upper wick and little to no lower wick, with the opening and closing prices near the session’s low. This candlestick formation typically occurs at the end of an uptrend and suggests a potential reversal in the market sentiment. Traders view the Gravestone Doji as a bearish signal, indicating that buyers attempted to push prices higher but failed, resulting in a potential shift toward downward momentum.

Dragonfly Doji:

Contrary to the Gravestone Doji, the Dragonfly Doji exhibits a long lower wick and little to no upper wick, with the opening and closing prices near the session’s high. This formation often occurs at the end of a downtrend and signals a potential reversal in market sentiment. Traders interpret the Dragonfly Doji as a bullish signal, suggesting that sellers tried to push prices lower but failed, indicating a possible shift towards upward momentum.

Four-Price Doji:

The other form is the Four-Price Doji, also known as the Rickshaw Man or Rickshaw Doji, is a rare formation characterized by a small body with both upper and lower wicks of equal length, similar to the Classic Doji. However, unlike the Classic Doji, the Four-Price Doji indicates extreme market indecision and uncertainty. Traders view this candlestick pattern as a sign of potential trend reversal or continuation, depending on its context within the price action.

Conclusion:

In forex trading, benefits of understanding the nuances of candlestick patterns, particularly the various types of Doji candles, can provide traders with valuable insights into market sentiment and potential price movements. While each type of Doji candlestick carries its significance, traders need to consider these patterns within the broader context of technical analysis and market conditions. By incorporating the analysis of Doji candles into their trading strategies, forex traders can enhance their ability to identify potential entry and exit points, manage risk effectively, and make informed trading decisions.

Source: Image and some other information is taken from Dailyfx